BSE (Bombay Stock Exchange) achieved a historic milestone as the cumulative market capitalization of all listed companies surpassed ₹400 lakh crore – a historic milestone for the Indian stock market. On April 4, the NSE Nifty rose by 0.64% to reach a new peak of 22,619, while the BSE Sensex advanced by a massive 600 points to reach an all-time high of 74,501 points.

Driving Forces Behind BSE’s Milestone

This record-breaking accomplishment, which highlights the tenacity and capacity for expansion of the Indian economy, was driven by strong corporate earnings, positive investor sentiment and significant domestic and international inflows. Realty, PSU banks, Auto, Energy, Infra and Pharma saw some of the strongest growth.

April 2023 onwards, the market capitalization of companies listed on the BSE has increased by approximately ₹145 lakh crore – a growth rate of approximately 57%. The blue-chip BSE Sensex saw a rise of 25%, while the midcap and smallcap indices surged ahead of the benchmark index, increasing by 68% and 63% respectively.

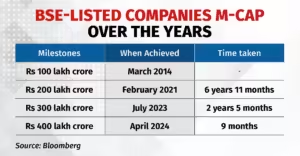

The path to this historic milestone has been marked by consistent growth and exceptional tenacity. The Bombay Stock Exchange, or BSE, crossed the ₹100 lakh crore threshold in March 2014 and then ₹200 lakh crore in February 2021. Nine months have passed since the stock exchange’s July 2017 peak of ₹300 lakh crore and its combined market capitalization has now hit ₹400 lakh crore.

A confluence of factors, such as strong economic indicators, growing domestic investment, and a stable political environment, is responsible for this boom. With a recent GDP growth rate of 7.6% and positive corporate earnings estimates, India stands out in South Asia.

Market Rebounds Despite Concerns

The Reserve Bank of India and Securities and Exchange Board of India, among other regulatory organizations, have expressed alarm about market frothiness, yet the Indian stock market has continued to rise, exceeding expectations and surpassing key milestones. The durability of India’s capital markets was shown last month when regulatory interventions intended to limit inflows into small-cap funds were met by a robust market rebound.

Positive Perspective on Current Government?

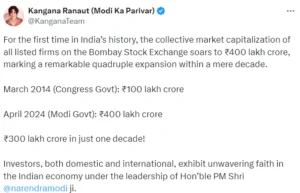

The renowned Bollywood actor Kangana Ranaut praised the accomplishment as a “remarkable quadruple expansion,” highlighting the exceptional growth trajectory under Prime Minister Narendra Modi’s direction. Ranaut highlighted the significant growth under the current government through a tweet:

Market Eyes Continued Growth

As for the future, market players see continued political stability leading up to the Lok Sabha elections, with past trends pointing to a possible Nifty 50 index increase. Strong economic fundamentals and encouraging financial reports from large corporations have the Indian stock market primed for further growth and wealth creation, thereby reaffirming its place as a prominent player in the global financial landscape.

Comments 2