The Platinum Industries IPO, which concluded on February 29, witnessed a remarkable response from investors, indicating robust demand for the company’s shares. Investors across various categories eagerly participated in the offering, resulting in a subscription rate of 98.92 times.

This extraordinary level of oversubscription is a testament to the market’s confidence in Platinum Industries and its growth potential. The IPO received bids for 95.38 crore equity shares against the offering size of 96.32 lakh equity shares, demonstrating overwhelming interest from investors.

Institutional Participation of Platinum Industries

Qualified institutional buyers (QIBs) played a pivotal role in driving the subscription numbers, subscribing to the IPO by a staggering 151 times the allotted quota. This enthusiastic response from institutional investors underscores their confidence in Platinum Industries’ business model and future prospects.

Qualified institutional buyers (QIBs) played a pivotal role in driving the subscription numbers, subscribing to the IPO by a staggering 151 times the allotted quota. This enthusiastic response from institutional investors underscores their confidence in Platinum Industries’ business model and future prospects.

Non-institutional investors also displayed significant interest, oversubscribing their portion by 141.82 times. Retail investors, known for their participation in IPOs, eagerly participated in the offering, bidding nearly 51 times the shares reserved for them. The widespread participation across investor categories reflects the broad-based appeal of Platinum Industries’ IPO.

Utilization of IPO Proceeds

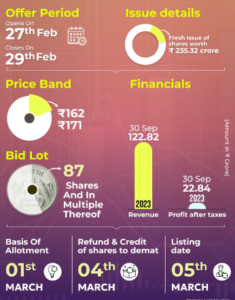

Platinum Industries, established in 2016, aims to raise Rs 235.32 crore through its maiden public issue. The IPO comprises a fresh issue of 1.37 crore equity shares, with a price band set at Rs 162-171 per share.

Platinum Industries, established in 2016, aims to raise Rs 235.32 crore through its maiden public issue. The IPO comprises a fresh issue of 1.37 crore equity shares, with a price band set at Rs 162-171 per share.

The company intends to utilize the funds raised from the IPO for strategic initiatives aimed at fueling its growth trajectory.

A significant portion of the proceeds will be allocated towards setting up manufacturing facilities for PVC stabilizers in Egypt and Palghar, Maharashtra.

The establishment of these facilities is expected to enhance the company’s production capabilities and cater to growing market demand.

Additionally, funds will be allocated towards meeting working capital requirements and supporting general corporate purposes. Platinum Industries’ prudent utilization of IPO proceeds underscores its commitment to driving long-term value creation for its stakeholders.

Post-IPO Timeline and Market Outlook

Following the conclusion of the IPO, Platinum Industries is set to finalize the basis of allotment for IPO shares by March 1. Equity shares are expected to be credited to eligible investors’ demat accounts by March 4, enabling them to participate in the company’s growth story.

Trading of Platinum Industries’ equity shares will commence on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) from March 5 onwards. The listing of Platinum Industries’ shares on the stock exchanges is eagerly awaited by investors, with anticipation for a strong debut.

In the grey market, an unofficial platform for IPO trading, Platinum Industries witnessed a premium of over 50 percent above the upper price band, indicating positive market sentiment and investor optimism. While grey market premiums provide an indication of potential listing prices, actual market dynamics may vary.

However, the overwhelming response to Platinum Industries’ IPO and the positive market outlook bode well for the company’s future performance and investor confidence.

The overwhelming response to the Platinum Industries IPO underscores the market’s confidence in the company’s business fundamentals and growth prospects. The strong oversubscription across all investor categories reflects broad-based investor interest and highlights Platinum Industries’ appeal as an investment opportunity.

With the successful completion of the IPO, the company is well-positioned to execute its strategic initiatives and drive value creation for its stakeholders.

With the successful completion of the IPO, the company is well-positioned to execute its strategic initiatives and drive value creation for its stakeholders.

Platinum Industries’ prudent utilization of IPO proceeds towards expanding its manufacturing capabilities and meeting working capital requirements signifies its commitment to sustainable growth and long-term value creation.

By investing in infrastructure and operational enhancements, the company aims to capitalize on emerging market opportunities and strengthen its competitive position in the industry.

As Platinum Industries prepares for its listing on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), investors are eagerly anticipating its market debut. The positive sentiment observed in the grey market, with a premium of over 50 percent above the upper price band, reflects investor optimism and confidence in the company’s future prospects.

Looking ahead, Platinum Industries is poised to embark on a new chapter of growth and expansion as a publicly listed company. With a strong foundation and a clear growth strategy in place, the company is well-equipped to navigate the evolving market landscape and deliver value for its shareholders over the long term.

As investors prepare to participate in Platinum Industries’ growth journey, they recognize the company’s potential to create value and generate returns in the dynamic business environment. By aligning with Platinum Industries’ vision and strategic objectives, investors have the opportunity to be part of its success story and capitalize on the potential opportunities ahead.

ALSO READ: Elephant House of Sri Lanka partners with Reliance Consumer for Indian beverage sales

Comments 2