Sony’s India unit said that it is looking forward to hearing Zee’s proposal to complete the merger with the company.

ZEEL had approached Culver Max Entertainment Pvt. Ltd. and Bangla Entertainment Pvt. Ltd. (BEPL) to extend the deadline to complete the proposed merger, which would create India’s $10 billion largest media powerhouse.

Sony Pictures Networks India, the local unit of the Japanese media conglomerate, said on Tuesday that it “has not yet agreed to an extension.”

Overview of Sony-Zee Merger

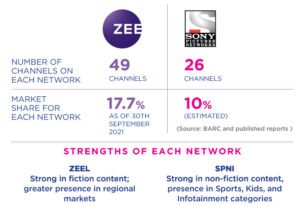

Zee Entertainment Enterprises Limited (ZEEL) announced its merger with Sony Pictures Networks India (SPNI). This was announced by the company on 22 September, 2021.

It was said that after the merger, Sony will invest $1.57 billion (Rs 11,615 crore) and will be the majority shareholder of the company with a controlling stake of 52.93 percent. ZEEL shareholders would hold the remaining 47.07 percent stake.

The ZEEL Board approved the merger. It has been reported that. Punit Goenka will be the Managing Director and CEO of the merged entity.

The ZEEL board said in a statement that apart from just the financial criteria assessed, the merger would also add strategic value to the partner company.

According to The ZEEL board the merged entity will be a listed company in India. A 90-day period was given in the term sheet. In August 2022, the National Company Law Tribunal, or NCLT, approved the merger of Zee and Sony.

Zee’s stock rose as much as 20 percent on the stock market after the news broke. 5 Lenders Axis Finance, JC Flower Asset Reconstruction, IDBI Bank, IMAX Corporation, and IDBI Trusteeship had earlier filed a petition in the National Company Law Tribunal challenging the privatization of Zee and Sony.

However, the application was dismissed by the National Company Law Tribunal (NCLT) in August 2023. In this context, the obstacles to the merger of the two media organizations were cleared last month.

Then, last August, NCLT said that there was no obstacle to the merger of Zee and Sony. “The huge company that will be established by these two media companies will be worth 10 billion dollars”, NCLT said.

SEBI, and the stock market had already given the green light for this merger. The merger will create the largest entertainment company in the country. When 5G and Sony merge, the company will have 70 channels, two OTT platforms (G5 and Sony Live), and two film studios (Zee Studios and Sony Pictures India).

Sony yet to accept Zee’s request

PunitGoenka was said to be the CEO and the Managing Director ( MD) of the newly merged company. However, allegations of diversion of funds against Subhash Chandra and his son Punit Goenka were expected to block Sony’s merger with Zee Entertainment Enterprises Ltd. Therefore, according to the SEBI order, they cannot hold any position on the board or hold the position of key director in any listed company.

The market regulator organization took this action when it received allegations of siphoning funds from the company.

Chandra and Goenka approached the Securities Appellate Tribunal (SAT), challenging SEBI’s interim order.

The merger was supposed to be completed by December 21, two years after the two media businesses signed an agreement dated December 21, 2021.

As per the terms of the merger, Zee and Sony have granted the extension for three times.

But if Sony decided against it, Zee would have to pay a $100 million termination fee.

Zee Entertainment Enterprises said on Sunday that it requested Culver Max Entertainment Private Limited (formerly Sony Pictures Networks India Private Limited) for an extension of the timeline to complete the merger.

Shares of Zee Entertainment were last seen trading at Rs 269.85, down 3.81 percent from their previous close of Rs 280.55. Despite the decline, the stock is up nearly 46 percent over the past six months.

The extension request came after two independent directors failed to confirm their reappointment to the Zee board.

But Sony has not yet agreed to Zee’s request. Sony said that the Notice (from zee) agreement invoked an existing contractual provision that allowed both parties to discuss the possibility of extending the deadline. Those conversations are “necessary” to begin but have not yet agreed to extend the merger deadline.

While the Zee-Sony merger has received regulatory and shareholder approval, it still needs approval from the Ministry of Information and Broadcasting (MIB) and the Registrar of Companies.

For MIB clearance, Sony will have to submit the names of directors who will occupy the board of the merged entity. As Punit Goenka is facing a regulatory probe, it could not submit the list.

Zee has been insisting that its CEO Punit Goenka – also the son of its founder – will lead the new entity, as agreed in the contract signed in 2021, while Sony is wary of his appointment due to a regulatory probe against Goenka.

Due to legal troubles, Sony has been appointing its India head, NP Singh, as Managing Director of the new entity. However, Goenka did not follow this advice.

“We look forward to hearing Zee’s proposals and how they plan to complete the remaining critical closing conditions,” it said in the statement.

A Zee spokesperson declined to comment on Sony’s statement. Shares of Zee fell 4.8% in Mumbai trading, S&P BSE 100 -A became the worst performer of the day.

Future Profits

Once this merger is completed, it will create a $10 billion media powerhouse with leading positions in TV, OTT, and content creation. FY23 financials show that ZEEL and Sony’s combined revenue was around Rs 15,000 crore.

Sony-Zee’s deal with Netflix Inc. and Amazon.com Inc. will challenge global powerhouses.

The deal will help expand Sony’s media business in the world’s most populous country, with more than 75 television channels and a 37% market share, compared to Disney-owned Star’s 24%, according to a note by brokerage firm Motilal Oswal Financial Services Ltd.