TCS (Tata Consultancy Services Ltd.), the leading Indian IT services company, has concluded its fiscal year 2023-24 on a high note with robust financial performance, reporting a strong Q4 with a 9% increase in net profit and a final dividend of ₹28 per share.

Robust Q4 Performance

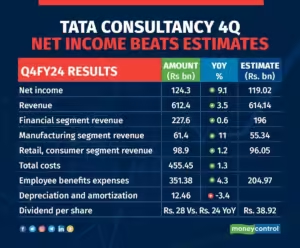

TCS reported a consolidated net profit of ₹12,434 crore for the fourth quarter of FY24 – a substantial 9% increase compared to ₹11,392 crore in the same period last year.

Revenue Growth and Margin Expansion

The company’s revenue for the quarter stood at ₹61,237 crore, representing a notable 3.5% rise year-on-year, according to a press release (April 12). While revenue missed analyst estimates, the company beat profit expectations.

TCS witnessed a significant improvement in its operating margin (EBIT margin), which rose to 26% for Q4 FY24, up from 25% in the previous quarter. This expansion in margins surpassed analysts’ forecasts.

Full-Year Performance

For the full fiscal year 2023-24, the firm achieved a revenue growth of 6.8% year-on-year, reaching ₹240,893 crore. The company’s net profit for the year amounted to ₹46,585 crore.

TCS’ Dividend Announcement

The company’s board approved a final dividend of ₹28 per equity share for the financial year 2023-24. This final dividend, along with previous interim and special dividends, brings the total dividend payout for FY24 to ₹73 per share.

TCS has a consistent track record of returning value to shareholders through dividends and buybacks. In the past 12 months, the company has declared an equity dividend amounting to ₹69 per share, with a dividend yield of 1.77 percent at the current market price.

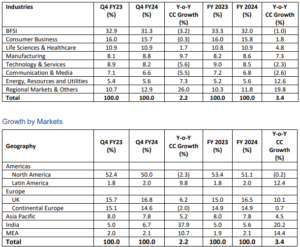

While the firm experienced a marginal decline in revenue from North America (2.3% year-on-year), its largest market segment, other regions such as India and the UK exhibited growth (37.9% and 6.2% respectively).

Despite market headwinds, TCS secured a record $13.2 billion worth of orders in the fourth quarter, including a significant 15-year deal with UK insurer Aviva.

Revenue from banking, financial services, and insurance (BFSI) clients, TCS’s biggest vertical, fell by 3.2 percent year-on-year, reflecting ongoing industry challenges.

Workforce and Market Performance

TCS reported a reduced attrition rate of 12.5 percent, along with annual increments for its workforce. However, the headcount declined sequentially by 1,759 employees in the January-March period.

The firm’s shares closed at ₹4003.80 per share on the BSE (Bombay Stock Exchange), highlighting a 0.48% increase from the previous day’s closing. The exact impact of the Q4 results announcement on the market will be seen on April 15 as the results were announced after market hours.

Outlook and Strategy

Looking ahead, Tata remains cautiously optimistic about the business environment, given global macroeconomic uncertainties. The company continues to prioritize customer-centric innovation, operational agility and talent development to drive growth and profitability.

CEO K. Krithivasan emphasized that FY25 is expected to be a better year than FY24, with growth likely to return in the coming quarters, driven by improvements in major markets.

The #TCSQ4 FY 2023-24 results are out and here’s what our leaders have to say.

Download the Press Release:

— Tata Consultancy Services (@TCS) April 12, 2024

Comments 1